Living Trust Software For Mac

May 18, 2020 If you are using the software to save money, make sure that a living trust is what you need. Living trusts are used to designate a trustee to disburse or manage property after a person dies. The key difference between a will and a living trust is how the property is handled after death. Feb 04, 2020 WillMaker Plus came with 1 year free access to the Revocable Living Trust software which is what I was primarily interested in. Between WillMaker Plus and the Trust software, my parents now have a organized estate which includes the trust, pour-over wills, healthcare power of attorney, and financial power of attorney documents in a California. Welcome to the MAC Trust Online University! We are pleased to provide you with this state-of-the-art Risk Management, Human Resources, Loss Prevention and Law Enforcement training at no additional cost. Our goal is to provide value added innovative solutions for your training needs. Living trusts are available from estate planning attorneys, off-the-shelf software, and online resources, such as Nolo. A living trust is most appropriate for individuals who have complex financial or personal circumstances, such as substantial assets, a blended family.

The following link will take you there: here's another link that will take you to a list of video tutorials that also cover many of the various features QuickBooks has to offer: you again for reviewing our software, Christopher!Clay, The QuickBooks Team. Software for macs. We're proud to be backing Pace Products inc, Christopher. Thank you so much for sharing your lovely review with us, as it's wonderful to hear that you find the program so easy to use.I want to ensure you have all of the resources you need to help those you train get past the learning curve that is usually associated with a new program. It's a resource hub filled with a wealth of self-help knowledge articles that cover a wide range of QuickBooks-related topics. For this reason, I encourage you to check out the QuickBooks Community website.

A living trust is a legal document created by you (the grantor) during your lifetime. Just like a will, a living trust spells out exactly what your desires are with regard to your assets, your dependents, and your heirs. The big difference is that a will becomes effective only after you die and your will has been entered into probate. A living trust bypasses the costly and time-consuming process of probate, enabling your successor trustee (who fills basically the same role as an executor of a will) to carry out your instructions as documented in your living trust at your death, and also if you’re unable to manage your financial, healthcare, and legal affairs due to incapacity.

Living trusts are available from estate planning attorneys, off-the-shelf software, and online resources, such as Nolo.

A living trust is most appropriate for individuals who have complex financial or personal circumstances, such as substantial assets, a blended family, closely held business interests, or property in other states. If you have a complex situation or are uncomfortable trusting your personal knowledge and judgment with such important issues, you might consider hiring a qualified estate-planning attorney to draft this document. Yes, you’ll spend more money, but you can rest assured knowing that your wishes will be carried out exactly as you desire.

A living trust can also be a very effective tool for an unmarried individual, regardless of financial situation, presuming that the individual’s desires can’t be fulfilled by utilizing beneficiary designations and the joint with rights of survivorship titling option and powers of attorney.

The two types of living trusts are as follows:

Revocable living trust: With a revocable living trust, you transfer your assets into the ownership of the trust. You retain control of those assets as the trustee of your revocable living trust. You can change or revoke the trust at any time you want. The assets in the trust pass directly to your beneficiaries without going through probate upon your death. However, neither wills nor revocable living trusts avoid or minimize estate taxes.

Irrevocable living trust: An irrevocable trust allows you to permanently and irrevocably give away your assets during your lifetime. After you give away these assets, you have relinquished all control and interest in these assets. Due to that fact, these assets are no longer considered part of your estate and aren’t subject to estate taxes. As you likely imagine, an irrevocable trust is appropriate in only extremely rare circumstances, such as when you have more money than you or your spouse could ever use. Your beneficiaries would benefit at Uncle Sam’s expense if you utilized an irrevocable trust to reduce your taxable estate before your death.

Living trusts (revocable or irrevocable) typically cost $1,000 to $3,000 per person.

Estate planning can be very tedious for attorneys as they may be dealing with multiple clients at the same time and maintaining all the documents gets tiresome. An estate tax planning software can be used to keep complete track of all the relevant documents in one place and everything can be linked. Free estate planning software is very easy to use and can be downloaded for any platform like estate planning software for mac and other such software that will be compatible on all platforms.

Related:

Estate Planning Software for Attorneys

This software is designed to make estate planning easy for the attorneys by enabling automated will and trust documents. Interviews with clients can be done easily and an online questionnaire can be built for preparing a living trust, power of attorney and will. The online resources help you learn more about your client’s needs and the language is easy to understand on this premium software.

Estate Planning and Probate

This software can be used in areas like small law firms, estate planning, personal injury, real estate law and family law. It will help protect the assets of the clients and distribute it properly. Materials, questionnaires, and automated documents can be prepared easily. Correspondence can be done every day and managing emails, file attachments for signature can be done with ease on this free software.

Nolo’s Estate Planning

This offers the complete estate planning bundle with a Windows-only will maker and two e-books for further information. It helps the users in learning how to create a will and other such important estate planning documents. They will be able to learn how to leave the property through a trust and organize all the family records with ease.

Living Trust Maker for Mac

This premium software is compatible on the Mac platform and contains two modules. The WillMaker has modules that are related to the living will and final arrangements document. The Living Trust Maker is a document assembly package that can be used for creating living trust documents. It explains all legal concepts and other such important details.

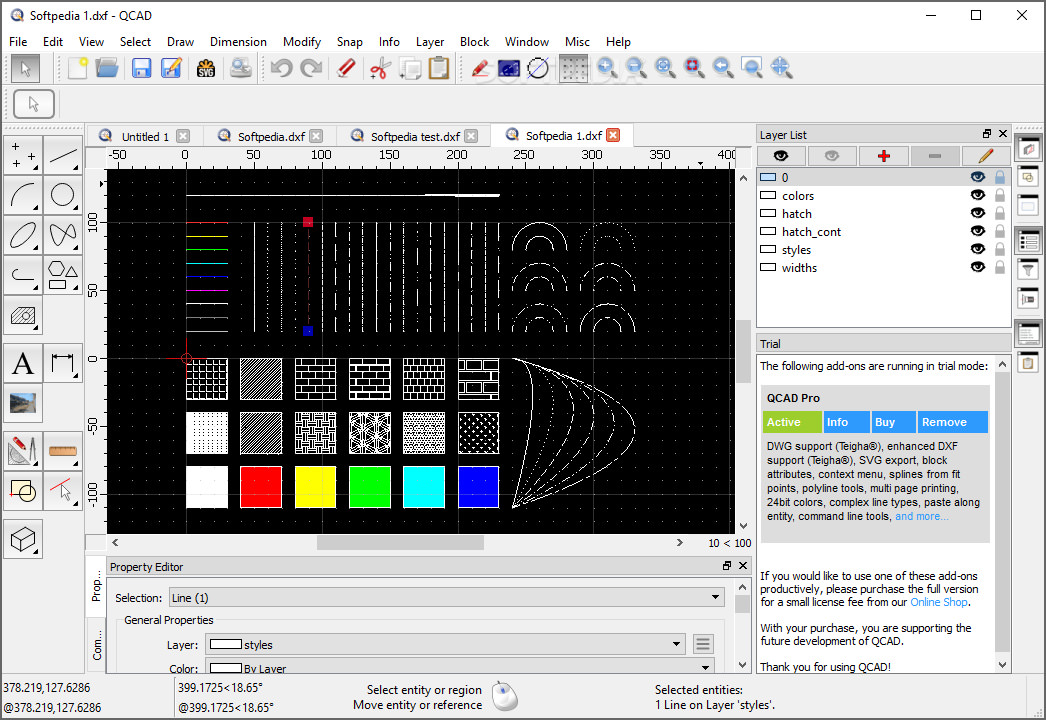

This free CAM software created by MecSoft Corporation is a programming software for CNC mills. The milling module is used for programming mills and routers and any number of codes can be done.

Quicken WillMaker Plus for Windows

This is a premium software that is compatible with the Windows platform and can be used for creating customized estate plans with the necessary legal documents like a will, power of attorney, final arrangements, health care directive and other such details. It is very user-friendly and the plans can be customized as per your wish. It requires Windows Vista/ 7/ 8/ 8.1/10 to work.

View Legal Estate Planning for Android

This Android app can be used to narrow down some of the wide areas that might be probably relevant in the topic of implementing or updating an estate plan. It generates information on the various strategies.

Living Trust Software For Attorneys

Most Popular Software – Online Estate Planning Software

This free online software can be used to create the estate plan with all the required documents. It helps users to create, store, update and share the plans to protect your legacy. Trust and will be generated and supporting documents can be maintained in this software. You can also see 3D Room Planner

How to install Estate Planning Software?

When you are looking to create your estate plan you need to be careful about all the details that you put in before handing it to the lawyers. All the supporting documents like a will, power of attorney, trust certification, final documents, etc. should be attached. You can also see Office Layout Software

For this purpose, a free estate planning software can be used. Most of the software are available for free or at a price. These can be downloaded and used on the required platform like estate planning software for mac which is to be used on Mac.

These estate tax planning software helps people and attorneys keep better track of the documents and gain a great deal of knowledge about the process. It will help in protecting your legacy and safeguard the interests of your family members.